7 Reasons Why SoundHound Stock (SOUN Stock) is a Smart Investment for 2025

Published on: 10 Apr, 2025

.png)

With the ongoing advancement of artificial intelligence (AI) and voice recognition technology, SoundHound Inc. (SOUN) has emerged as a compelling growth company. SoundHound is making an impact in several industries with its disruptive voice AI solutions, including automotive and hospitality. For investors looking for a top growth AI stock opportunity, SOUN may be a thoughtful stock investment idea in 2025. Adoption of AI-driven voice assistants continues to steadily gain adoption, and SoundHound is entering into high-value markets- making it well-positioned for growth.

If you are thinking of adding SOUN stock as a stock investment to your portfolio, in this blog we have come up with seven convincing reasons that it could be a smart stock investment for 2025.

Understanding SoundHound’s Market Position

SoundHound (SOUN) is becoming a serious player in the voice AI space, taking on industry titans Google, Amazon, and Apple. Its next-generation speech recognition platform and AI-powered voice solutions are attracting interest in various industries, such as automotive, customer support, and hospitality.

Revenue Growth

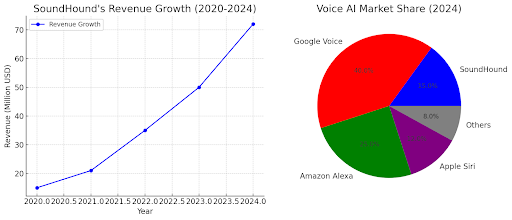

The growth in revenue is depicted in the chart, and it truly shows a very robust upward trend for SoundHound. Revenue has consistently risen from 2020 to 2024. This progressive increasing revenue reflects the demand and increasing adoption of AI solutions. Partnership program efforts and the expansion of services offered by the company contribute to this financial growth and make SoundHound a good investment.

Market Share

Although a relatively small-sized player compared to Google Voice and Amazon Alexa, SoundHound still commands a respectable 15% share in the voice AI market. The pie chart illustrates a competitive scene with Google being the largest player at 40%. However, SoundHound's niche product and proprietary technology provide the company with a solid advantage allowing it to grow a loyal customer base.

7 Reasons to Invest in Soun Stock in 2025

Searching for a smart investment opportunity in 2025? Well, SoundHound (SOUN) stock is creating excitement with AI and voice technology, establishing itself as a force in the marketplace. With accelerating innovation, multiple partnerships, and revenue growth, SOUN stock has high-potential upside for investors. Want to know why? Here are 7 terrific reasons to consider SoundHound in your portfolio, this year!

1.Growing AI Voice Technology Market

Voice AI market will see exponential growth in the future. And the industries such as automotive, customer service, and smart devices are becoming more dependent on AI-driven voice solutions, many opportunities await SoundHound. As more organizations look for AI-driven customer interactions, the technology of SoundHound becomes a true differentiator.

2. Strong Revenue Growth Potential

SoundHound has been recording consistent revenue growth backed by collaborations with blue-chip brands and companies. With the rapid adoption of AI, its subscription and licensing-based revenue model guarantees a durable income stream. Investors seeking equities with long-term earning potential should watch out for SOUN.

3. Strategic Partnerships and Collaborations

An admirable aspect of SoundHound is its effective collaboration with car and technology manufacturers such as Hyundai, Mercedes-Benz, and Kia. These are the companies that integrated SoundHound's AI voice assistants into their cars. This quality showcases these companies' trust in SoundHound. These partnerships add to the brand's notoriety in the industry.

4. Competitive Edge Over Big Tech

While giants like Google Assistant and Amazon Alexa may be ruling the market, SoundHound's standalone AI voice assistant stands as a formidable competitor. In contrast to the competitors, SoundHound allows flexibility in integration for businesses without throwing them into an ecosystem. This gives it an edge, with the result being the company having many customers from various sectors.

5. Powerful AI and Machine Learning Features

SoundHound is pioneering Natural Language Processing (NLP) and AI technology. Their proprietary Speech-to-Meaning® and Deep Meaning Understanding® technology enables quicker and more precise voice interactions. The AI space is infiltrating plenty of industries and SoundHound's revolutionary technologies may arouse interest in it's offerings.

6. Increasing Demand in Automotive and IoT Industries

The automotive industry is rapidly adopting voice A.I. technology for hands-free use and better user experience. SoundHound's AI-based solutions are already being utilized in smart cars and IoT devices. As connected and autonomous cars gain traction, demand for voice-controlled A.I. will increase, which enhances SoundHound's market focus.

7. Favorable Valuation for Long-Term Investors

In spite of its increasing visibility, SoundHound's stock remains underpriced relative to larger AI companies. This is a chance for investors to purchase at a cheaper price before it can rise possibly. With its solid fundamentals and expansion plans in the market, SOUN could yield huge returns in the long term.

5 Risk and Considerations Related to Investing in SOUN Stock

1. Competitive Market Pressure

SoundHound is in a very competitive field that is dominated by technology giants Google, Amazon, and Apple, which have huge resources and established AI-based voice assistants. Although SoundHound stands out with sophisticated natural language processing and an adaptable business model, it is still a challenge to compete with these technology giants. If bigger companies develop their AI capabilities further, it might restrict SoundHound's growth prospects.

2. Financial Stability and Profitability Concerns

SoundHound is in a very competitive field that is dominated by technology giants like Google, Amazon, and Apple. Which have huge resources. With its solid fundamentals, this is a chance for investors to purchase at a cheaper price before it can rise possibly. It is still a challenge to compete with these technology giants.

3. Adoption and Integration Risks

SoundHound's success relies on mass adoption by industries and businesses that use voice AI technology. If businesses are slow to switch from current solutions such as Google Assistant or Amazon Alexa, SoundHound can fail to achieve mass adoption. Integration issues with current enterprise systems could also impede client onboarding, hindering revenue growth.

4. Market Volatility and Stock Fluctuations

Similar to most tech stocks, SOUN is prone to market volatility. AI stocks tend to have sudden and intense price fluctuations because of investor mood, sector trends, and broader macroeconomic variables. Short-term unpredictability may pose risks for investors who crave stability, necessitating an acute analysis of the stock's behavior prior to investing.

5. Data Privacy and Regulatory Challenges

As a voice AI business, SoundHound processes huge volumes of user data. More stringent global regulations on data privacy (e.g., GDPR and CCPA) may have stricter compliance obligations, which would result in increased operational expenses. Any security breach or non-compliance could damage the company's reputation and lead to legal repercussions

Conclusion

SoundHound's AI-driven voice technology is changing industries and its

stock may be a good investment for 2025

. With respected partners, a growing market presence, and advanced technology, SOUN could provide significant returns. As humanity moves towards an AI-powered future, buying SoundHound's stock may be a prudent investment for those looking to provide capital into the voice AI's future. Pay attention to this stock as it could become your next champion!Would you include SOUN stock in your investment portfolio? Let me know in the comments!

About the Author

Sakshi

Sakshi is the foremost authority on YouTube and Facebook marketing. On IDhistory, he shares insights collected during his experiences managing promotional campaigns for brands and creators, using YouTube and Facebook marketing tools, and planning advertising for those platforms.

Related Blogs

222 Angel Number: A Guide to Spiritual Balance and Alignment in 2025

15 Apr, 2025

vnROM Bypass vs Other FRP Unlock Tools for 2025

14 Apr, 2025

Red Office Chair Ideas And Tips

14 Apr, 2025

25 Best Gift ideas for Girlfriends in 2025

11 Apr, 2025

7 Reasons Why SoundHound Stock (SOUN Stock) is a Smart Investment for 2025

10 Apr, 2025

Top 100 Sweet & Spicy Truth and Dare for Girls Night

10 Apr, 2025

Palantir Stock: How Trade War May Affect The PLTR Stock Prices and What to Do

09 Apr, 2025

Meena Alexander - Biography & Works

09 Apr, 2025

7 Ways to Build a Winning Portfolio with 5StarsStocks

04 Apr, 2025

Space x Recent Launch

04 Apr, 2025